Articles

- Home

- Articles

Articles

-

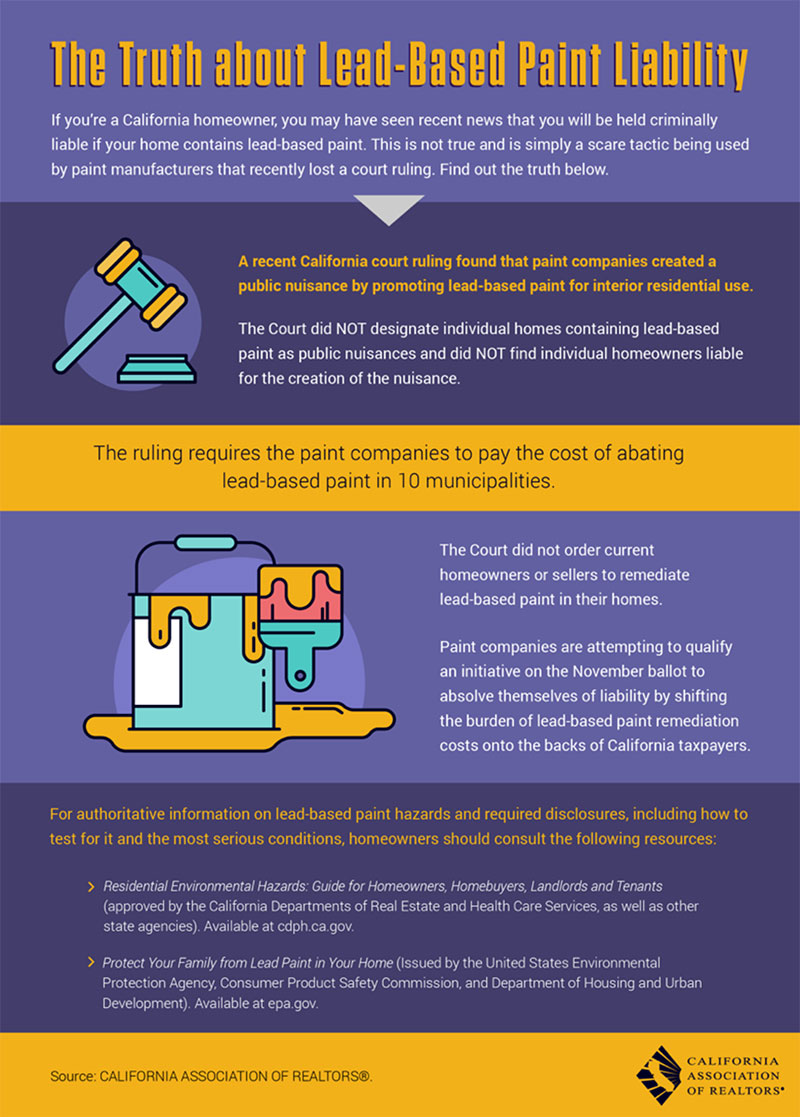

The Truth about Lead-Based Paint Liability

If you're a California homeowner, you may have seen recent news that you will be held criminally liable if your home contains lead-based paint. This is not true and is simply a scare tactic being used by paint manufacturers that recently lost a court ruling. Find out the truth below.

-

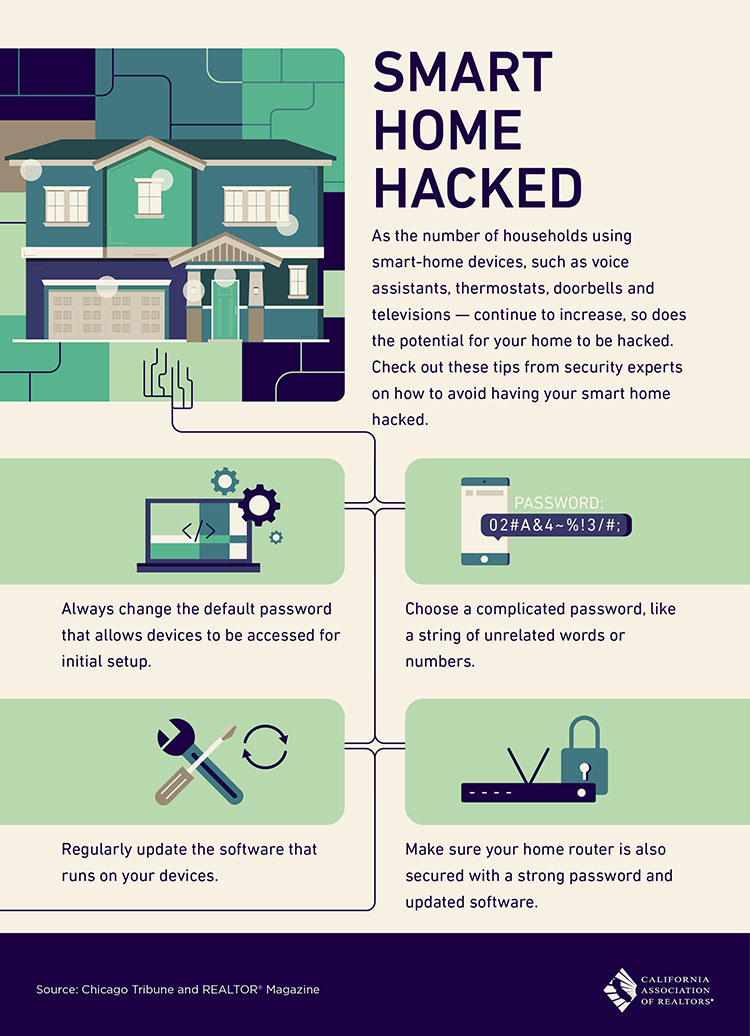

smart home hacked

As the number of households using smart-home devices, such as voice assistants, thermostats, doorbells and televisions - continue to increase, so does the potential for your home to be hacked. Check out these tips from security experts on how to avoid having your smart home hacked.

-

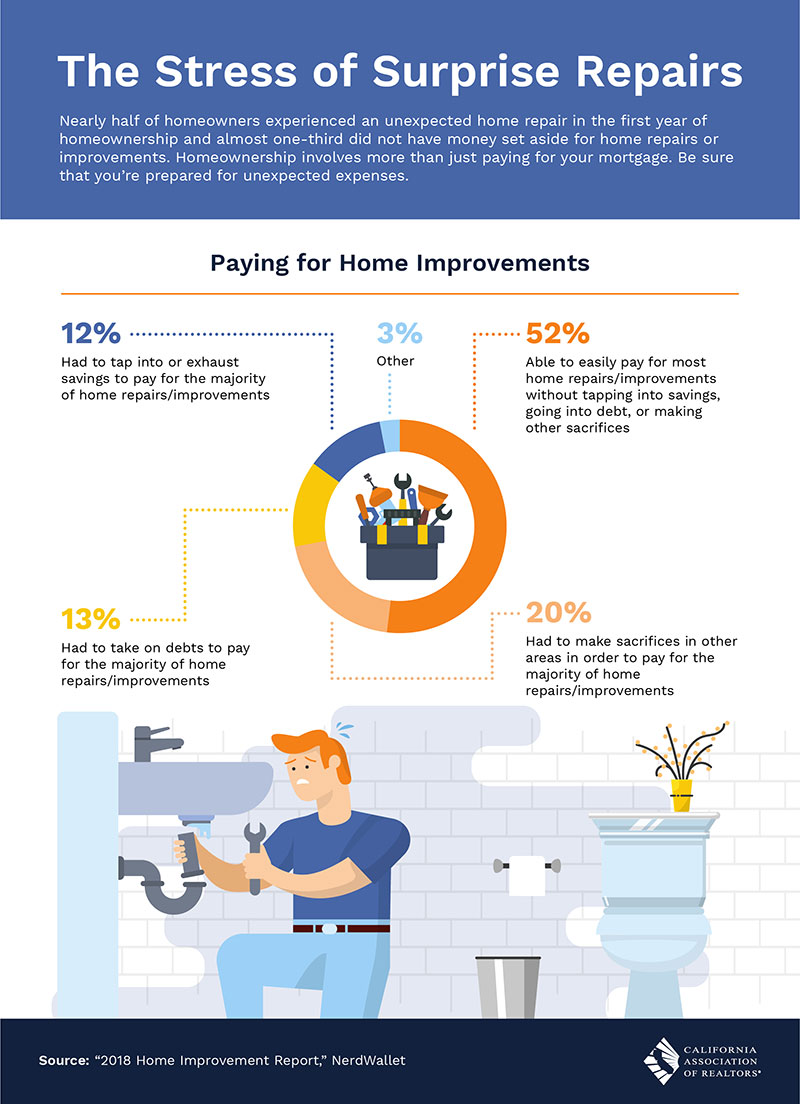

The Stress of Surprise Repairs

Nearly half of the homeowners experienced an unexpected home repair in the first year of homeownership and almost one-third did not have money set aside for home repairs or improvements. Homeownership involves more than just paying for your mortgage. Be sure that you're prepared for unexpected expenses.

-

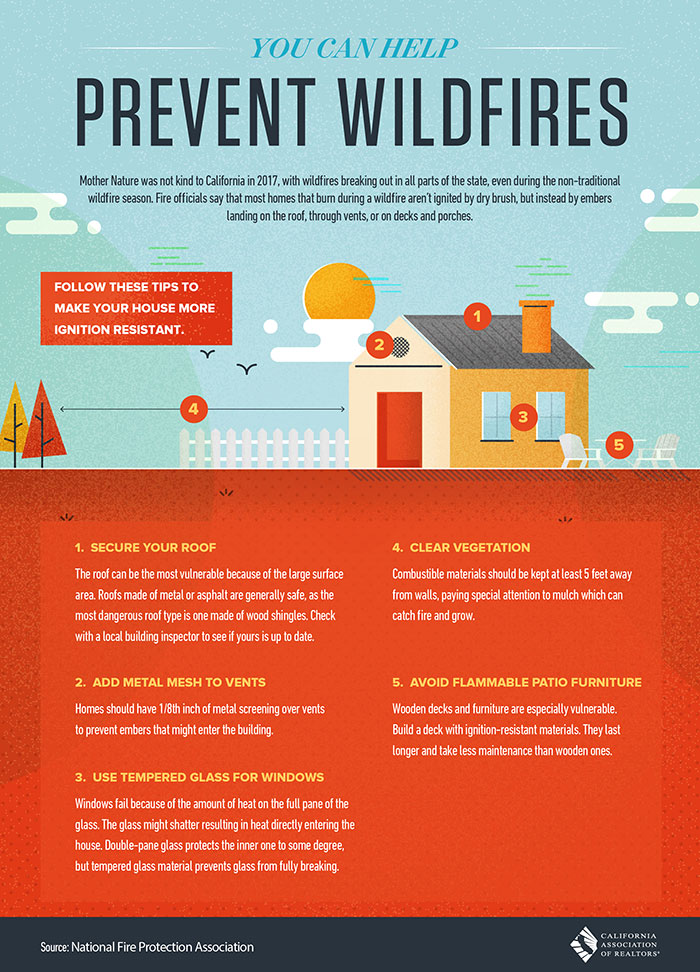

Prevent Wildfires

Mother Nature was not kind to California in 2017, with wildfires breaking out in all parts of the state, even during the non-traditional wildfire season. Fire officials sa that most homes that burn during a wildfire aren't ignited by dry brush, but instead by embers landing on the roof, through vents, or on decks and porches. Follow these tips to make your house more ignition resistant.

-

California homeowners face higher insurance costs after fires

www.cbsnews.com

January 31, 2019California's new insurance commissioner, Ricardo Lara, delivered bad news earlier this week to Golden State homeowners about wildfire insurance losses and policy premiums. Lara said estimated insurance costs for the 2018 wildfires, which devastated towns such as Paradise and Redding and caused massive destruction in Malibu, had risen by $2.3 billion to $11.4 billion -- a 25 percent increase and a record for the state.

Total losses from California's more than 8,000 wildfires exceeded $18 billion last year. But the steep insured losses also mean higher premiums for homeowners and businesses, including the 3.5 million homes in harm's way from future blazes.

Just how much will rates rise? If a December 2017 report from the California Department of Insurance (CDI) -- issued before the state's worst fire year -- is any indication, those who previously paid $800 a year for a policy could now be charged up to $5,000. Insurers said additional hikes are inevitable.

Follow the link below to read full article.

-

Family pets can have a significant influence when homebuyers are shopping

www.cbsnews.com

January 31, 2019On average, prospective homebuyers visit 10 properties over 10 weeks until they find their new home. It turns out that one of the more prominent reasons a home search gets extended is furry and walks on four legs.

That’s right: if a house doesn’t pass “the pet test,” it’s out of the running.

The healthy economy that is spurring talk of a rate hike, however, isn’t permeating deeply into real estate.

A survey by Realtor.com found that 75 percent of pet-owning home buyers would pass up an otherwise-perfect home if they didn’t think it was a good fit for their animals.

That’s a significant percentage considering that finding the right property ranks as the most difficult step in home buying.

Eighty percent of the people surveyed owned pets. Of those:

87 percent took their pets' needs into account when looking for a home.

Nearly 90 percent of pet-owning buyers said that their animals' needs were important or very important in their home-search process.

90 percent of dog owners and 87 percent of cat owners said their pets' needs were important or very important during their home search. But reptiles (98 percent), horses (91 percent), and fish (87 percent) also factor into decision making.

So, what are some of the most important features for pet owners?

A large yard (45 percent)

Any outdoor space (36 percent)

A garage (33 percent)Source: Ann Timoney, Financial Advisor and Mortgage Advisor

NMLS 233794 | CFP® - OPES Advisors

750 University Avenue Suite 275, Los Gatos, CA 95032

(408) 458-3504 Office | atimoney@opesadvisors.com